Read how The MetroHealth System fully realized the benefits of using Epic + Quadax together, allowing them to achieve up to a 98% CCR.

Stay informed on the latest industry news, best practices, and trends in revenue cycle management for hospitals and physician groups.

Read how The MetroHealth System fully realized the benefits of using Epic + Quadax together, allowing them to achieve up to a 98% CCR.

The CAQH Index is a detailed report that addresses how reducing the burdens of administrative costs could reduce healthcare spending. The 49-page report is incredibly insightful and full of information, but in order to make it more digestible, we’ve pulled some statistics we found most valuable. All of the data in this post is directly from the CAQH report and the full report is available on their website through the link at the bottom of this blog.

The Current State of Administrative Costs

The healthcare industry spends an estimated $350 billion annually on administrative costs – due to its complexity. Of these costs, $40.6 billion is associated with transactions that are tracked by the CAQH Index. The Index states that $13.3 billion or 33% of those tracked costs could be saved by completing the transition from manual and partially electronic processing to fully electronic processing.

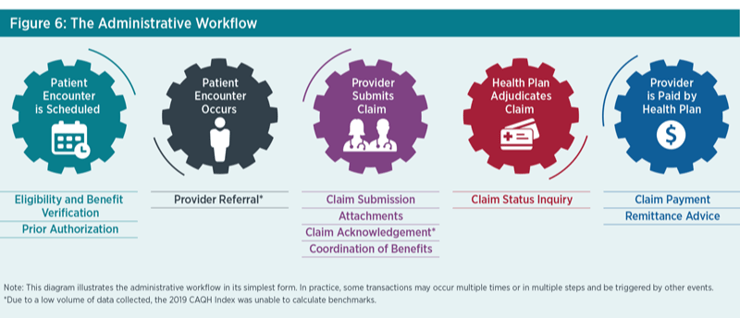

The Administrative Process

*Figure 1. Source: 2019 CAQH Index

The medical industry could save as much as $42.45 (including $29.27 for providers and $13.18 for plans) for a single patient encounter by requiring all eight of the transactions tracked to use a fully electronic workflow.

The greatest per transaction savings from moving from manual to fully automated can be realized in the following areas:

Eligibility and Benefit Verification

Eligibility and Benefit Verification transactions represent the highest annual spending and savings opportunity. This is due to the large overall volume of this transaction and the volume conducted through partially electronic web portals. This transaction accounts for 47% of the total medical industry spend. Providers have indicated that complicated benefits have resulted in additional points of contact with plans, and providers check on eligibility and benefit information multiple times throughout an encounter.

The medical industry could save 85 cents per transaction by conducting eligibility and benefit verification electronically using the HIPAA standard as opposed to a web portal. In addition, medical providers could save 8 minutes per transaction by switching to fully electronic processing – adding even more savings.

Prior Authorization

Prior Authorization is the costliest and most time consuming to conduct manually. Industry adoption of electronic prior authorization is lower than other transactions due to provider awareness, vendor support, inconsistent use of data content allowed in the standard, state laws mandating manual processes, and lack of an attachment standard to support the exchange of medical documentation.

Moving from web portals to fully electronic could save $2.11 and 17 minutes per transaction, as the time is slashed from 21 minutes to four.

Claim Submission

Claim submission continues to have the highest electronic adoption rate, which is critical to sustain in order to control costs. The rate of fully electronic processes has remained steady at 96% compared to the prior report. Even though this transaction is mostly automated, there is still $635 million in savings opportunity through complete automation.

Electronic Attachments

Serving as a bridge between clinical and administrative data, attachments are critical to the success of value-based payment models. As we transition from fee-for-service to value-based payment, there is a clear need for clinical and administrative systems to streamline the exchange of information to support patients, providers and plans.

Although attachments are primarily exchanged through costly and time consuming manual methods, the volume of these transactions is low, accounting for less than one percent of the total volume of administrative transactions. An average of $4.50 and 11 minutes of staff time is spent on each manually processed attachment.

Coordination of Benefits

Adoption of electronic coordination of benefits has the second highest adoption rate and the fastest growth among the transactions. The spend associated with this transaction is the lowest among the medical industry administrative transactions reported. Medical plans could save an additional $16 million by switching their remaining manual COB transactions to electronic.

Claim Status Inquiry

Claim status volume decreased for the second year in a row. This is partially because providers now only check on the status of a claim after a minimum of 30 days versus more frequently, which may be due to quicker adjudications and payments from plans.

This transaction accounts for 15% of medical spend and is the second most expensive transaction to conduct manually ($10.13) and electronically ($2.41). On average, it takes 12 minutes to conduct a manual claim status inquiry and only four minutes for electronic.

Claim Payment

The volume of claim payments rose 18%, however, claim submission volume is higher because payments are often made in bulk where one payment is associated with multiple claims.

Paper checks, on average, take five minutes to process compared to three minutes electronically. By conducting claim payments electronically, the medical industry could save $135 million annually.

Remittance Advice

The adoption of electronic remittance advice (ERA) transactions increased slightly from the last report. Roughly 20% of the total spent on administrative transactions is around remittance advice.

On average, medical providers reported that an ERA required two minutes of staff time compared to seven minutes when conducting the transaction manually.

The Industry Call to Action

To support adoption of fully electronic transactions that can accommodate evolving market needs, limit cost and reduce burden, CAQH proposes the following actions for the industry to help maintain and improve upon the achievements accomplished to date:

For more information about the CAQH Index, please visit www.CAQH.org. You can download the full CAQH report here. Quadax can help your organization automate any of these transactions, whether you’re a hospital, laboratory or physician practice. Let’s talk!

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Administrative overhead is a real burden for many providers. Technology and automation have been mandated by the Centers for Medicare and Medicaid in certain parts of healthcare processes, but overall, the healthcare industry is way behind in utilizing technology and automation for increased efficiencies and profit. This blog will explore the latest findings from the Council for Affordable Quality Healthcare, Inc. (CAQH) as well as some of the potential reasons providers don’t pursue automation, despite its proven benefits.

The seventh annual report from CAQH found that prior authorization costs are the most costly, time-consuming transaction for providers. On average, providers spend almost $11 on each manual prior authorization, which is up from $6.61 just a year ago. Obviously, the costs are significantly lower for partially and fully electronic transactions, at $4 and $2 respectively, but automation of prior authorization transactions remained very low in 2019.

Why is it so difficult? Unfortunately, there are several reasons:

1. Data inconsistency

Payers don’t use the same codes to communicate prior authorization status, errors and next steps, including the need for clinical documentation to prove medical necessity. Standardization and transparency is needed to make the process easier for all involved.

2. No standardized clinical documentation

Health plans require different levels of clinical documentation detail for prior authorization requests to help determine medical necessity and appropriateness. This lack of standardization makes it difficult to automate a prior authorization response.

3. Lack of clinical and administrative system integration

Bi-directional integrations between practice management systems and clinical systems, like electronic health records, are uncommon, which means data has to be manually entered into one system from another. This represents an opportunity for human error and a drain on productivity and efficiency.

Despite the known barriers, not much progress is being made year over year. The CAQH found that adoption of prior authorizations increased by only one percent from 2018 to 2019 to 13% overall. However, the CAQH just approved a 2-day rule to accelerate the prior authorization process, and 80% of industry stakeholders are in agreement.

The rule outlines the following timelines must be met 90% of the time within a calendar month:

This new rule is very encouraging, considering the health plans participating in the CAQH represent 75% of the insured population in the United States. This rule will not only help reduce administrative costs for providers, but more importantly, it will help save lives by ending delays in care caused by prior authorization requirements.

If you’re interested in reading about best practices for mitigating prior authorization challenges, check out this whitepaper.

The top 5 challenges facing healthcare today can all be mitigated by a healthier revenue cycle. This blog will explore changes you can make in your rev cycle to address and even conquer these challenges, outlined by Managed Healthcare Executive.

Challenge #1: Costs & Transparency

It’s a bit shocking that we’re going into 2020 with so many offices not being able to accurately confirm a patient’s eligibility or provide an accurate out-of-pocket amount that will be owed for the service provided. If your team struggles with providing this information, there are tools you can easily implement to remove these challenges.

The right patient access solution (as part of a revenue cycle management platform) can help you reduce denials due to avoidable pre-service errors, which typically account for 50% of denials, in addition to:

Challenge #2: Consumer Experience

Most Americans aren’t able to correctly define copay, deductible and premium. These same folks typically will avoid going to the doctor for recommended or even required services because they’re afraid of the cost and confused by the overall experience. After all, healthcare is the #1 cause of bankruptcies in the United States, so the fear is legitimate.*

It shouldn’t be unreasonable for a patient to know what to expect throughout their entire experience of receiving care. A strong revenue cycle management solution should be able to help you:

Identify –

Communicate –

Collect –

Providing this information to your patients not only ensures a positive experience for them, it relieves a huge burden from your staff by not having to deal with frustrated and confused patients. This resource guide can help you explain common healthcare terms to your patients. We encourage you to print it and make it available to your patients.

Challenge #3: Delivery System Transformation

Being able to provide care to those that don’t have easy access is a growing challenge.

Critical Access Hospitals (CAH), designated by the Centers for Medicare and Medicaid Services, are designed to reduce the financial vulnerability of rural hospitals and improve access to healthcare by keeping essential services in rural communities. Because of the immense financial constraints CAHs face, resources can’t afford to be wasted. Optimizing efficiencies within their revenue cycle provides a significant opportunity to reduce operating costs and improve productivity. These facilities should be required to use technology to optimize their revenue cycles so staff isn’t wasting time on activities that could be easily automated.

Challenge #4: Data & Analytics

Just having access to data isn’t enough. Revenue cycle teams need actionable data – they need to be able to make necessary changes and improvements based on the data they have. It’s great if you know what percentage of claims are being denied, but do you know why they’re being denied? Are there certain providers that are denying claims at a higher rate? Is there a specific procedure code that’s being denied more than any other?

Actionable data helps you:

Challenge #5: Data Interoperability

Accessing data between disparate systems is a common challenge in healthcare. We’ve talked with large healthcare systems that are looking to consolidate their vendors, even if that means foregoing unique functionality that a specific vendor provides, in order to eliminate data silos.

The right revenue cycle solution should be able to feed data into your EHR and other critical systems so you can access your data wherever and whenever you need it. And the solution should be comprehensive enough to allow you to manage your entire revenue cycle process without needing additional vendors to supplement missing functionality.

The Bottom Line

Money makes the world go round. The revenue cycle is the lifeblood of a healthcare organization. If managed at it’s highest efficiency, your organization will reap the benefits of maximum reimbursements and staff productivity – with streamlined resources.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Source:

*CNBC Medical Bills Are the Biggest Cause of US Bankruptcies: Study, Dan Mangan June 2013

With all of the attention on healthcare transparency, it seems ironic that Americans are more and more confused about healthcare, specifically their insurance policies. Continue reading “Healthcare Providers Must Educate on Patient Financial Responsibility”

The initial issues of this blog will lay a foundation of understanding that will allow us to do a deeper dive into healthcare-related issues.. Continue reading “Taking a Trip Down Healthcare’s Memory Lane”

It’s the most wonderful time of the year! Or is it? Continue reading “Finding Your Balance During The Most Wonderful Time of the Year”

If you think managing the healthcare revenue cycle is challenging now, brace yourself because there are several forces that are likely to drive more complication and complexity into the revenue cycle. Recent analyses of hospital finances are painting a complex picture – Medicare spending cuts, declining service volumes, rising costs, a shrinking payer mix, underutilized technology and increasing financial waste are all threatening the profitability of our hospitals and providers.

We’re Getting Older

As more and more baby boomers reach the age of 65, the mix of profit-generating commercial business and break-even to unprofitable government payers will continue to shrink. In addition to the increasing Medicare population, reductions in federal payments to hospitals will total $252.6 billion from 2010 to 2019, according to a new report commissioned by the American Hospital Association and the Federation of American Hospitals.

To compound the issue of an aging population and cuts in federal reimbursement, a report from Fitch Ratings predicts the third straight year of declining profitability for the nonprofit hospital sector, but not as steep as the previous two years. Finally some good news!

No More Passing the Buck

As the nation transitions from fee-for-service reimbursement to value-based care, coordinated efforts amongst an array of providers are required to improve quality and efficiency of patient care – and reimbursement. Under this approach, providers are financially rewarded for positive patient outcomes and efficient care delivery. This is a major shift in behavior from the traditional fee-for-service model, where providers are compensated for each test, treatment, and medication, regardless of patient impact.

While the goal of value-based reimbursement is expected to improve our population’s health, the shift in approaches brings along a new set of challenges for the healthcare industry. While many organizations are hiring care management coordinators and behavioral health support staff members to build the necessary infrastructure for value-based care, many are still citing the following as barriers to adopting this standard of care:

Regardless of these challenges, with only 39.1% of healthcare payments made in 2018 under a fee-for-service structure and the increased industry demand for value-based care, profitable provider organizations need to partner with each other and insurers to deliver value rather than passing the buck back and forth.

A Lot of Money is Wasted

Imagine throwing 25% of your paycheck right out the window. That is how much of healthcare spend in the United States is wasted. Administrative complexity is responsible for the most waste ($265.6 billion) – billing and coding errors and time spent reporting on quality measures. The authors of the report cited opportunities to reduce administrative waste through insurer-clinician collaboration and data interoperability.

The United States spends almost twice as much as other high-income countries on medical care despite similar utilization rates. Administrative costs were again identified as a major driver in the overall cost difference amongst the United States and other high-income countries.

The Data Struggle is Real

We are constantly surrounded by technology – from streaming TV, to an app that lets you see and speak to someone at your front door while you’re hundreds of miles away, to your Amazon packages being delivered by drones. There is no doubt that we are in the era of advanced technology, but adoption and investment in technology is still in its early growth stage in the healthcare industry. There could be several reasons why, including:

Data interoperability is the key to these problems facing the healthcare industry. Being able to exchange, interpret, use and share data amongst other providers, payers and even the patients themselves would undoubtedly cut down on administrative waste and enhance the implementation of value-based care.

There is Hope!

These challenges are daunting, but the right partner can shed the necessary light and get your organization’s revenue cycle where it should be to maximize your revenue. Quadax is more than a revenue cycle management solution provider. We are in lockstep with our clients from the beginning and that service and commitment never ends. If you’re ready to learn how Quadax can help your organization support a growing Medicare population and a value-based care model while decreasing your administrative waste and making your data work for you, reach out any time!

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

Ken Magness is a focused healthcare professional with more than a decade of experience in helping clients understand the true value of automation in the revenue cycle management process. As the Strategic Initiatives Leader at Quadax, Ken and his team are passionate about connecting with healthcare providers to help them create and leverage the appropriate technology solutions to optimize the revenue cycle process and improve the experience of their patients and staff.

With Election Day behind us and the upcoming Presidential election in 2020, Medicare for All is one hot topic. Continue reading “Eliminating Medicare Denials is More Important than Ever!”